Black Tax: A term originating in South Africa that refers to the financial responsibility that many young working professionals, specifically POCs, shoulder to support their families and households.

Disclaimer: This article is not intended to offend any person or household that upholds the black tax practice, I am merely addressing the black tax practice as a cultural phenomenon in a general light.

South Africa’s socio-economic outlook is characterised by a unique and complex phenomenon known as “Black Tax”. While the concept of supporting family members is a well-known universal value, it is even embedded in the term Ubuntu, the systemic and historical factors in South Africa have led to a distinctive form of financial pressure on the younger generation- Nowadays, people are even referring to it as ‘generational billing’

Historically, Black Tax is deeply embedded in the country’s history of apartheid and economic disparities. During the apartheid era, black South Africans were systematically excluded from economic opportunities, resulting in widespread poverty and limited access to education. The legacy of this injustice persists today, with many black families still grappling with financial challenges and financial illiteracy.

Now that it is December, being back home from university means you are constantly having conversations about your future with your parents. Whether it’s about your career plans or that res partner you have to tell your parents about, they love to be in the loop of things. Now that the job hunt has also begun for some of us, I was comforted by my mother telling me that she and my father have no expectations from me as far as financial contributions are concerned. But, I know this is not the case for everyone. Many might be dreading finishing university, knowing that the real responsibility of taking off family members is yet to come.

It’s one thing knowing that your parents are cared for – knowing that you don’t have to shoulder the full responsibility of caring for them is a complete game changer. Now I can’t imagine working a low-income earning job (which is the reality of being a new graduate) just to live a half-life because my income is needed to maintain someone else’s livelihood.

I fully understand the traditional implications of black tax, and its esteemed practice in society, particularly for its positive socio-economic benefit for families who find themselves in a perpetual cycle of poverty- someone has to be the change, but it’s quite disheartening knowing that the responsibility falls on someone that hasn’t even made sense of their own futures yet.

It just so happened that after I had that conversation with my parents, I stumbled upon a tik tok made by @tattooedpa in which the opening line was “Parents need to stop looking at their kids as their retirement package, and as some sort of asset in an asset portfolio that is meant to give some sort of dividends at the end of every month” and honestly, the comments to the video expressed similar sentiments as people mentioned the complexities of juggling financial freedom with financial responsibilities towards their parents and other, sometimes even extended family members.

Now, I know, that everyone’s responsibility towards their family looks different, but we should maintain that indifference between everyone’s responsibility is ultimately, choice. You should feel empowered to make those choices that benefit your family, but you should feel just as empowered to refrain from those that limit your mobility as growing independent individuals in a society where systemic inequities are already a deterrent to some form of a ‘prosperous future’.

While Black tax may reflect a commitment to family and community, it also poses significant challenges for young professionals striving to build their own lives. Addressing Black Tax requires a comprehensive approach that combines individual financial education that can be offered by community initiatives in your area. Communities can also offer a forum for discussion in which solutions can be found. You can also seek to address this through advocacy for policies that address economic disparities, create more opportunities for marginalised communities, and promote inclusive economic growth is crucial. This includes addressing issues such as affordable education, job creation, and social welfare programs.

Lastly, and probably most applicable, if you are a firm believer in black tax but have concerns about balancing your personal obligations with those of your family, Companies can play a role in supporting employees facing the challenges of Black Tax. This could involve employee assistance programs, mentorship initiatives, or flexible work arrangements that accommodate familial responsibilities. When you apply for a job, consider their prospective employers’ corporate policies!

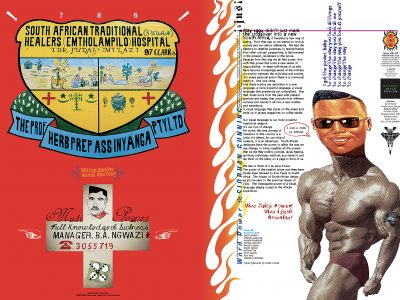

Image courtesy of Tumelo Mnola/City Press